3 Good News For Investing Your Finances in 2024

Wiki Article

What Are Some Of The Best Bonds Investment Options For 2024?

A smart strategy for 2024 is to invest in bonds to help with income generation, diversification and risk management. Here are some of best ways to purchase bonds in 2018: Government Bonds

U.S. Treasury Bonds - These bonds are guaranteed by the government of the United States and are considered to be one of safest investments. They are available in a variety of maturities: short-term (T-bills) medium-term (T-notes) and longer-term (T-bonds).

Municipal Bonds - issued by the state and local government They provide an interest rate that is tax-free. This makes them appealing to investors who fall in the higher tax brackets.

Inflation Protected Securities: These Treasury bonds are indexed to inflation. This protects against inflation.

Corporate Bonds:

Bonds of Investment Grade The bonds are issued by companies who have a good rating and are financially solid. They offer moderate returns but less risk than lower-rated bonds.

High Yield Bonds or Junk Bonds issued by companies that have lower ratings for credit, these bonds offer higher yields as a way of compensating for the riskier nature.

Bond ETFs and Funds

Bond Mutual Funds The funds collect the money of several investors to buy a diverse portfolio of bonds. They are managed by professional fund managers.

Bond ETFs are similar to mutual funds because they provide diversification, however they trade on stock exchanges, just like stocks. This means they have more liquidity, and lower costs.

Bonds of International Issue:

Emerging Market Bonds: Bonds from developing nations can provide higher yields, though they come with higher risk due to economic and political instability.

Bonds from Developed Markets: Bonds in developed countries can be a great option to diversify your portfolio and help stabilize it.

Green Bonds

Environmental, Social, and Governance, (ESG), Bonds They are issued to fund environmental green projects. They are a great choice for investors who appreciate sustainability and social responsibilities.

Convertible Bonds

Hybrid Securities. These securities are exchangeable in exchange for a specific number of shares. They are able to provide capital appreciation and income from bond interests.

Floating Rate Bonds:

Adjustable interest rates The bonds have interest payments which adjust every so often based on the benchmark interest rate. This helps reduce the risk of an interest rate increase.

Private Bonds:

Direct Lending and Private Debt: Private loans or bonds issued by companies can give higher yields. However they're more risky and possess less liquidity.

Municipal Bond Funds:

Diversified Municipal Investments (DMI): These funds are a part of a portfolio of municipal bonds. They offer tax-advantaged returns and diversification between various municipalities.

Laddering Strategy:

Bond Ladders: This method involves buying bonds with varying maturities. When bonds with shorter maturities are mature they can be reinvested in longer-term ones and manage liquidity, risk and the risk of interest rate.

Other Tips for 2020

Keep track of interest rates. Central bank interest rate policies can impact bond prices too. Knowing the current interest rate environment can help to inform your choice making.

Credit Ratings: Keep track of credit ratings for bonds prior to investing in order to minimize the risk of default.

Manage interest rate risk by considering the duration of your bonds. The bonds with shorter durations are less prone to fluctuations in interest rates.

Diversification - Diversify bonds by sector, geography, or type.

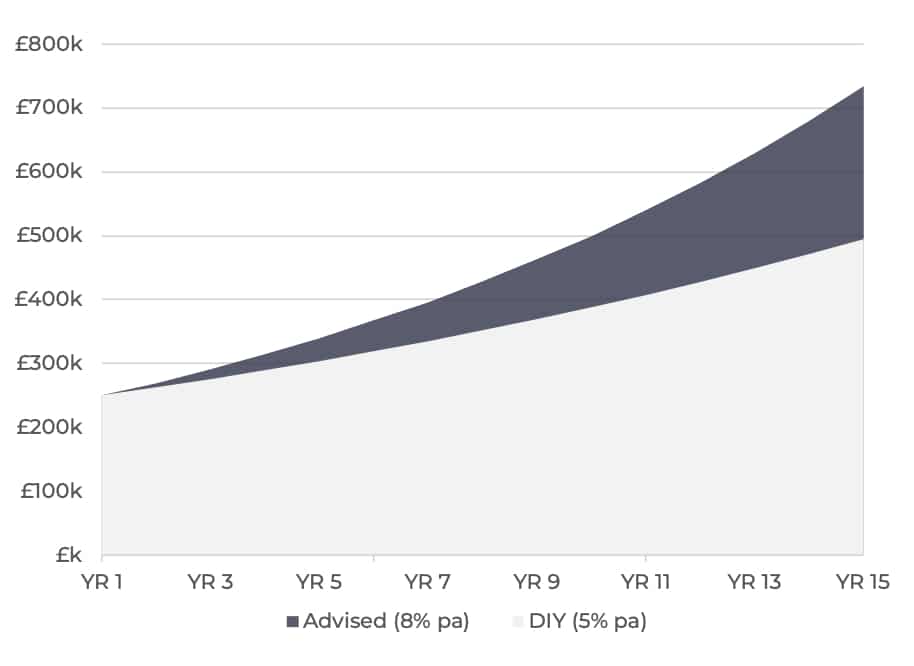

Professional Advice: Consult an expert in finance to assist in developing a bond plan to help you achieve your objectives in terms of finances and tolerance to risk.

By carefully choosing and diversifying your bonds, you can achieve an enlightened portfolio that generates income, preserves capital, and reduces risk in 2024. Read the top find for Cross Finance for blog examples.

What Is The Most Efficient Way To Invest In Commodities For 2024?

Commodities can be used to diversify your portfolio, and also as a hedge against the effects of inflation and economic instability. Here are the most profitable commodities you can invest in 2024. Physical Commodities

Precious metals: By buying physical gold, palladium silver, or platinum and silver, you will be able to create a tangible asset that has value. Also, you should think about the cost of insurance and storage.

Energy Resources - Investors who are not individuals rarely purchase physical commodities such as crude oil or crude gas due to logistical issues and lack of storage.

2. ETFs for commodities (and ETNs)

Exchange-Traded Funds (ETFs): These ETFs are able to track the value of their shares and are easily traded through stock exchanges. SPDR Gold Shares GLD as well as iShares Silver Trust SLV are two examples.

ETNs: Exchange-Traded Notes which track the prices of commodities. These products offer commodities exposure without the hassle of ownership in physical form.

3. Futures Contracts

Direct Investments Futures contracts permits investors to directly bet on future commodity prices, like those for oil, gas wheat, gold and other commodities. This involves understanding the futures market, and it is high risk due to leverage.

Managed Futures Funds. Expert managers provide expertise and risk management to control the risk of investing in futures contracts.

4. Commodity Mutual Funds

The funds pool money from investors and invest it in a diverse portfolio of commodities through futures contracts or direct holdings. They can provide professional diversification as well as management.

5. Commodity Stocks

Mining and Energy Companies (Mining and Energy Companies): This is investing in companies involved in the extraction and production of commodities. Examples include mining companies, oil and gas producers and silver and gold miners.

Agribusiness stocks can be utilized to increase exposure to commodities such as grain and livestock.

6. Real Assets and ReITs

Timberland and farmland: Direct investments in the land that is used for farming or forestry provide exposure to commodities, as well as generating income.

REITs Real Estate Investment Trusts. These REITs focus on natural resources, such as timber and agricultural REITs. These are indirect investments in commodities.

7. Commodity Pool Operators

They are managed investment funds which pool capital from investors and sell commodities options or futures. A professional management team and less entry costs are also possible.

8. Diversified Commodity Index Funds

These funds track an index of commodities, and offer diversification across various sectors like energy, agriculture, as well as metals. Bloomberg Commodity Indexes (BCI) and S&P GSCI indexes are utilized as examples.

9. Gold and Silver Coins

Bullion Coins. Coins that are issued by the government, such as Gold and Silver coins are a good way to invest in precious metals. They also have very high liquidity.

10. Digital Commodities and Tokenization

Blockchain-based Commodities: Certain platforms offer digital currency that is supported by commodities. This is a fresh method to invest in commodities that offers added liquidity and transparency.

Other Ideas for 2024's Year

Diversify across Commodities:

Don't concentrate your investment in a single commodity. Diversify risk by investing in various commodities (e.g. energy, agriculture, metals).

Market Dynamics:

Keep up to date with supply and demands factors along with geopolitical effects, as well as economic indicators that could affect commodity price.

Consider Inflation Insurance:

Commodities may serve as a hedge against inflation. In times of high inflation commodities can be priced higher and preserve the purchasing power.

Risk Management:

Commodities are volatile in nature. When investing, use strategies such as stop-loss or the ability to take risks.

Keep up-to-date with regulations.

Commodity markets can be subject to regulatory changes. Stay informed of any regulatory changes that may impact your investment.

Seek professional advice:

You should consider consulting with a financial planner to devise a plan for your investment in commodities that is tailored to your objectives and the risks.

By choosing and managing your commodities in a careful manner You can enhance your portfolio in 2024, and safeguard it from a variety of economic conditions.

What Are The 10 Most Efficient Ways To Invest Start-Up Funds As Well As Private Equity?

Making investments in private capital and startups can generate substantial profits. But it is not without risk. Here are five ways you can invest in private equity and startups for 2024.

1. Angel Investing

Direct Investment: Invest in startups at an early stage, typically as a way to get equity. It is typically a smaller investment that conventional venture capital.

Angel Groups Incorporating an angel investment group lets you pool resources for due diligence and share them. You will boost your investment opportunities and decrease risk by joining a group.

2. Venture Capital Funds

Venture Capital Funds (VC) investing in professionally managed VC Funds that pool funds and create a broad portfolio of startups. It lets you access high-growth companies that are professionally managed and are subject to due diligence.

Micro-VC funds: These are smaller funds focused on early stage companies and have a higher risk-to-reward ratio.

3. Equity Crowdfunding

Online Platforms. Utilize platforms such as Crowdcube (SeedInvest), Wefunder (Crowdcube) and SeedInvest to invest in promising companies through crowdfunding based on equity. These platforms permit smaller investment amounts to be made in exchange of equity. This makes investing in startups more accessible.

Due diligence is essential Be sure to read the business plans, market prospects and the team of each startup before you invest.

4. Private Equity Funds

Buyout funds: investing in a private equity fund that restructures and acquires mature companies with the intention of improvement in operations and eventually earnings.

Growth Equity Funds: Concentrates on investing into mature companies that need capital to expand their operations, explore new markets, or finance significant purchases.

5. Secondary Market Funds

Liquidity Solutions Investing: Secondary market funds buy shares from private companies and then sell the shares to investors who already have invested. This can provide liquidity as well as potentially lower entry costs.

6. Fund of Funds

Diversification. Invest in an investment fund which pools capital to several venture capital and private equity funds. This provides broad diversification over various sectors.

7. Special Purpose Vehicles (SPVs)

Targeted Investments - Join SPVs, which were created with the purpose of pooling investor money to make a single strategic investment in a specific company or an opportunity.

8. Direct Investments

Private Placements: Take part in private placements that allow companies to sell securities directly to accredited investors, providing the opportunity to invest in highly-potent private firms.

Strategic Partnerships Create strategic alliances or co-investment arrangements with other funds or investors to benefit from expertise and share risk.

9. Incubators and Accelerators

Mentorship Funding: Incubators and accelerators provide resources, mentorships and seed funds to early stage startups in exchange for equity.

10. Self-Directed IRAs

Tax-advantaged accounts: You could utilize a self-directed IRA account to invest in private equity and companies, which allows you to grow tax-advantaged. Be sure to avoid penalties by adhering to IRS regulations.

Other Tips for the Year 2024

Perform thorough due diligence:

Market Research: Find out the size of the market as well as the potential of it. Also, identify the degree of competition.

Management Team: Examine the management team members to determine their track records, experience and skills.

Financial Projections: Review the financial health of the company, its projections and business plan.

Diversify Your Portfolio:

Diversify your investments across industries, startups and growth stages to lower risk and maximize your potential return.

Be aware of the risks:

Be mindful of the dangers involved in investing in private equity companies or startups. There is a possibility that your investment may be lost completely. Allocate a small part of your investment portfolio to private equity.

Networking and Leverage expertise:

Relationships with experienced investors, experts in the industry, and venture capitalists can assist you to gain access to high quality investment opportunities.

Stay up-to-date with Trends

Be aware of current developments in the industry, as well as new technologies and economic conditions which can affect the startup and private equity scene.

Legal and Compliance with Regulatory Law

All investments must comply with all legal and regulatory obligations. Get advice from financial and legal experts to help you navigate the complexities of investing in private funds.

Exit Strategy:

Knowing your exit strategy for investments is crucial, regardless of regardless of whether you intend to sell, merge and buy, or conduct secondary sales.

These strategies can help you to balance your risk against the potential rewards of investing in private equity or start-ups in 2024.